No matter what type of product or service you offer, invoicing is likely part of your sales process. One could argue that it is the most important part – because the quicker you can get your invoices out, the quicker your organization will receive the customer’s funds.

Slow invoicing processes elongate the sales process and make it more cumbersome for everyone. Employees are required to manually input customer information, leading to more labor and more potential for error. Customers who are excited about purchasing your product can’t make their payment until your employees complete and deliver their invoice. Sometimes, the agent requires their assistance, asking them to provide information as they manually input it into their invoicing software. By the time the invoice arrives, it may wind up at the end of their extended “to-do” list.

You may think you need to only do invoicing from your accounting system, but thousands of businesses have found Salesforce to be the most comprehensive tool for invoicing. Salesforce’s ability to collect all types of customer information, and access that information when needed, makes it easy for businesses to pre-fill customer fields and send invoices quickly.

If you’re already using Salesforce, you’re in luck. Creating invoices in Salesforce is simple, allowing you to immediately improve your cash flow and automate an entire process that may be holding your organization back. And there are a variety of tools for making sure that those invoices are reflected in your other accounting, finance or ERP systems, if you are not running those on Salesforce yet.

In the following post, we’ll show you exactly how online invoicing can benefit your business – especially if you’re using Salesforce.

The State of Online Invoicing

If you’re still using paper-based invoices for your business, you’re not alone – but soon, you may be. Online invoicing isn’t new, but it has taken some time to catch on in the global arena. According to studies by Billentis, paperless invoices represent only 42 billion of the world’s 500 billion invoices. While this percentage (less than 10%) may seem less than impressive, studies suggest that the online invoicing industry will continue to grow by a whopping 10-20% per year.

In North America, especially, e-invoicing has already gained traction among small businesses and medium-sized enterprises (SMEs). In the United States, companies deliver approximately 24% of all bills electronically. With an anticipated increase of 14-18% per year in B2B transactions, the adoption rate of online invoicing technology will continue to rise.

Benefits of Online Invoicing

Simplifying the invoicing experience is critical to running a small business, especially since 27% say they have a hard time creating and sending invoices. Those who have switched to e-invoicing report enormous gains and benefits, and as more businesses transition successfully, others are inspired to convert their systems as well. According to surveys by EY, organizations using online invoicing solutions:

- Saved time by receiving payment much faster, only taking three days to process an invoice instead of 15 days when sending a paper invoice.

- Streamlined employee labor with more efficient processes. A full-time employee who could process 6,000 paper invoices per year can check over 90,000 electronic invoices in the same amount of time.

- Saved money by minimizing the costs associated with sending and receiving payment invoices.

Another significant benefit of online invoicing is being able to store your data in the cloud. Paper invoices are easily lost, and even when filed away correctly, they can be challenging to retrieve. While digital invoices saved on hard drives make it easier to organize, technical issues can lead to unretrievable files and lost client data. When kept in the cloud, invoices are safe and secure, and you can access them instantly from any connected device.

Of the small businesses that have integrated an online invoicing solution, around 12% of them pay upwards of $100 per month. But this pales in comparison to the amount they save by making their invoicing process more efficient. When factoring in the amount of time required to create, send, and process an invoice, a single paper transaction can cost a business between $4 and $20.

Online invoicing is a tremendous improvement over paper systems, but there are still limitations to many e-invoicing solutions. When evaluating invoicing options, whether Salesforce or another solution, ensure that they offer a combination of features that fit the specific needs of your business.

5 Must-Have Online Invoicing Features

Compared to paper processes, your organization will benefit from transitioning to any type of invoicing software. However, some invoicing solutions are more useful than others. When searching for an invoicing solution, choose a product that provides the following features:

- Electronic Payment: Customers who receive online invoices typically prefer to pay them online as well. Accounting software options like QuickBooks and PayPal allow companies to add a “Pay Now” or “Buy Now” button that directs customers to a secure payment page. This feature is not available in all invoicing software, however. Some solutions require the use of a separate software to collect payments, while others do not provide any digital payment options. Additionally, the solution you choose should allow customers to submit payment using their preferred methods, including credit card, debit card, and ACH bank withdrawal.

- Customizable Fields: Static fields may work for some businesses, but many organizations require their invoices to be flexible and customizable. The ability to build invoices directly from your customer data is an asset for many companies. Choose a solution that allows you to create invoices with dynamic fields specific to your customer, their purchase, and their account status.

- Confirm and Record Customer Information: Customers may want to update their payment information or pay with a different payment method than they did previously. Today’s top solutions allow customers to update their contact information, credit card information, or other essential details without needing to contact a representative of your organization.

- Follow Up: Sending an initial invoice is helpful, but if you want to streamline your payment process, you should have a system that can automatically remind customers of past-due invoices. Late and missed payments can delay cash flow, but a robust invoicing system will notify customers of their payment status promptly.

- Fraud Protection: When dealing with first-time customers or unusually large orders, it’s crucial to ensure that you have legitimate information for authorizing the payment. Your invoicing and payment system should allow you to protect yourself from fraudulent credit cards by requesting the name on the credit card, billing address, expiration date, CVV code, and the customer’s credit card number. Furthermore, it should enable you to catch any unusual entries, such as a mismatch between the billing address and shipping address.

As an invoicing tool, Salesforce offers all of these features, and more. Many organizations using Salesforce only as a Customer Relationship Management (CRM) system are surprised to learn how easy it is to produce quick, accurate, and effortless invoices.

Why Use Salesforce for Invoicing?

Companies maximize efficiency when they combine their invoicing system with a CRM solution. Salesforce provides numerous features to make invoicing more manageable and accessible. Here are the top benefits of using Salesforce to invoice your customers.

Invoice Automation

One of the most significant benefits of creating online invoices with Salesforce is automating the entire process. Salesforce enables you to establish workflows and triggers that will generate an invoice and automate its delivery to the customer’s email. Your organization can customize these workflows and triggers to a specific customer or project, or base it on a regular billing schedule.

By combining invoicing and CRM technology, automation becomes easier. Salesforce already has your customer data, and often, products and pricing on Opportunities, Quotes, and Order records, so these fields can be pre-filled – meaning you won’t have to manually input this data every time you send an invoice to the same client.

Salesforce Invoice Automation Example: Invoicing at Project Milestones

For project-based company billing, your Salesforce workflow can automatically initiate the invoicing process when reaching a key milestone. As long as you keep your project hours and expenses updated in Salesforce, you can immediately capture the revenue from those project tasks across each step in the project.

This system also works better for customers. They can gain visibility into a project status when the emailed invoice arrives with detailed line items that describe the project’s progress. Your customer can simply click “Pay Now” to view their detailed invoice and submit payment by either entering payment information, or using previously saved credit card or eCheck/ACH payment information.

Complete your invoicing system by adding the Chargent Payments for Salesforce app. Combining Chargent allows you to automate the payment process by adding a “Pay Now” feature to your invoices. When customers click this link, it directs them to a secure payment site where they can pay their invoice immediately and securely. Best of all, this payment information is captured directly in Salesforce, with a secure token stored for future use and complete transaction records of all payments.

Minimize Errors

Traditional Accounts Receivable (AR) processes require a substantial amount of manual input and data entry. Printing invoices and envelopes, opening mail from customers, and organizing payments can add several expenses and require hours of labor. In many cases, salespeople must manually enter transactions into Salesforce or re-enter data from payment systems that aren’t connected to their order or customer quoting systems. At any point where a manual action is necessary, you run the risk of human error.

When a manual entry is involved, mistakes happen – even when you are careful. Around 3.6% of all invoices contain errors, which is tremendous for a business that processes hundreds or thousands of transactions. Furthermore, in a recent AP Association survey, companies processing 350,000+ invoices each year cited invoice exceptions as being responsible for creating 36% of all supplier-related phone calls.

When your customers receive invoices sent digitally from Salesforce, they have all the transactional information they need at their fingertips. Since the process is automated, pulling data from the CRM, there is less risk for human error. If errors do occur, Salesforce allows you to fix them quickly and reissue an updated version to your customer immediately. On the other hand, paper invoices take more time to update and then must be resent to the customer through snail mail – potentially adding several days at best to the payment process.

Get Paid Faster

Introducing online invoicing software and combining it with automation can drastically reduce the amount of time it takes for your company to receive payment. With Chargent’s Payment Request feature, you can add a “Pay Now” button to your invoices, so payments happen in real-time, are processed immediately, and are automatically recorded on Salesforce.

Salesforce (combined with Chargent) offers many features that ease and eliminate unnecessary steps in the payment process. Here are a few notable features that can help your organization get paid faster:

- The system can create an invoice as soon as a defined trigger condition is met (such as reaching a project milestone or a specific order volume, or when an invoice is 60 days past due). No more waiting for regular invoice batch processing – instead, invoices are sent right at the time that customers are ready to pay them.

- Use Salesforce to send invoices immediately through email. With no-delay delivery, you’ll no longer have to wait for the post office to deliver your invoices, which can take several days or more.

- Integrate a “Pay Now” button on each invoice, enabling customers to pay directly on a secure Salesforce site through a digital payment method instead of writing and mailing a check, or needing to call during business hours to provide payment information over the phone

- After completing a payment, Salesforce immediately and automatically records the customer and transaction details, including failed payment attempts due to declined transactions. Employees no longer have to register these payments manually, and your business eliminates delays from processing and reconciling payments.

Salesforce invoices save time and help you to improve your cash flow. With fewer inefficiencies to delay the process, Salesforce can significantly reduce the amount of time between when you send an invoice, and when the payment is submitted and recorded.

Reduce Costs

Every business hopes to acquire more customers. The more customers you serve, the more invoices you will send. Organizations that send paper invoices deal with fixed and variable costs for each new invoice they send out. This fee differs among different industries and business types, but the average business assumes an expense of $7.99 to process a single paper invoice. Moving to an online invoicing system reduces this cost to $3.13 on average. These cost savings are seeing through a reduction in AR headcount, fewer mistakes from manual processes, printing, mailing, and other inefficiencies that impact the entire process.

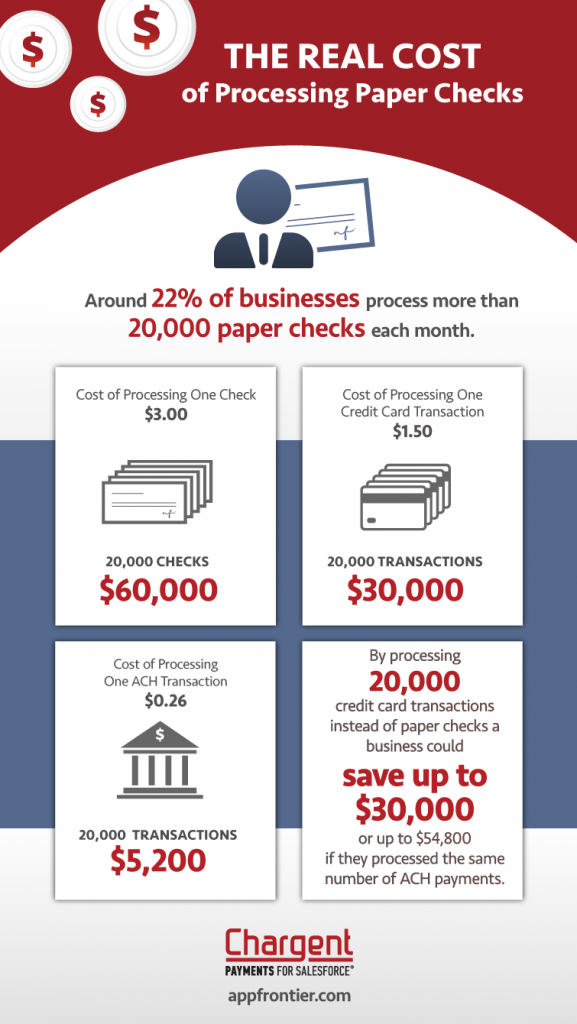

Accepting payments online allows you to reduce these costs even further. It can cost up to $3.00 to process a paper check transaction, according to the surveys by the Association for Finance Professionals. In comparison, processing an ACH payment only costs between $0.26 and $0.50 per transaction, and credit card transactions average around $1.50. These costs can quickly add up for businesses that process a large number of transactions each month.

According to the 2015 Payments Cost Benchmarking Survey, around 22% of businesses process more than 20,000 paper checks per month. If a company processed 20,000 credit card transactions instead, they could have saved $30,000 in a year – or $54,800 if these transactions were through ACH.

Transitioning to online invoicing, especially through Salesforce, will help your business reduce costs and earn higher margins on every transaction.

Better Customer Service

The rewards of online invoicing for your business are endless, and your customers share in these benefits. Adding a “Pay Now” button to your Salesforce invoice means that your customers can quickly pay with a credit card, debit card, or eCheck/ACH instead of writing and mailing a check. Just like your business, online invoicing also allows customers to save time and money.

After clicking “Pay Now,” customers are directed to a link customized with your logo and a branded message. In addition to submitting payment, they can conveniently choose their payment option, update outdated payment information, and provide authorization for future payments. With their payment preferences saved directly in Salesforce, future invoices take even less time and effort.

Salesforce invoicing provides an unmatched level of convenience. Since the entire process is online and automated, there are no office hours or hours of operation like in a human-based collection system. Customers can pay your invoice at any time and on any day, including weekends and holidays. If they are in a different time zone or working off-business hours, they can still conveniently pay your invoices through your Salesforce Payment Request site, no need to call during business hours to make a phone payment, or find a stamp and mail a paper check. When payments are quick, convenient, and free of errors, customers are more likely to pay them on time and without delay.

At the same time, if your customers do need personal attention, with invoicing information and payment transactions available right in Salesforce, any sales rep or customer service agent on your team (given the appropriate Salesforce permissions) can view, resend, or otherwise assist your customers with any invoicing inquiries.

Making Salesforce Invoicing Work for Your Business

Salesforce is a globally leading CRM solution, and when you use it for invoicing, your entire system becomes more streamlined and efficient. However, there are some limitations for certain types of businesses.

For example, businesses that collect recurring payments may find it difficult to set up automated invoicing using Salesforce alone. Fortunately, when you use Chargent as a Salesforce add-on, you can access valuable features like recurring payments, automated collections, and payment gateway integrations.

Using Salesforce to invoice your customers will save you time and money while making payment much more convenient for your customers. Chargent elevates these features and makes Salesforce invoicing flexible, especially for businesses with complex and non-traditional payment cycles and unique requirements.

While Chargent does not provide a full Salesforce invoicing system, with aging and statements, many Chargent customers find the Payment Request email template, customized to be structured like an invoice, to be a great lightweight solution for sending invoices from Salesforce and receiving payments in Salesforce, all in one easy record. For customers who have more detailed invoicing requirements, or want invoices more integrated with CPQ or financial systems, native Salesforce applications such as Accounting Seed or Salesforce Billing may “fit the bill”, with Chargent connected to handle the payments part of sales invoices.

Chargent has helped thousands of businesses improve their payment systems, and we know it will help you too. But you don’t have to take our word for it, just download our free 30-day trial and see for yourself.