Whether you prefer to call it dunning, accounts receivables, or collections, the process of collecting on debts presents a challenge to organizations of every size, across every industry. In fact, 50% of organizations surveyed for a recent Acuity report stated that they are actively trying to improve their payments process.

Better Collections with Automation

“Improvement” is a worthwhile goal – but how exactly do you accomplish this? And how do you measure your results?

Chargent’s Automated Collections add-on offers a powerful, configurable tool for payment collections. Automating early-stage collections activities like dunning emails and payment retries saves your organization time and money – and it all works seamlessly.

When a customer payment fails, your Automated Collections process triggers a friendly email communication with a payment request link. Next, Automated Collections retries the payment on a predetermined schedule, usually after a specific interval of time, or on a set date.

This process works really well for many payment scenarios – for example, a recurring billing customer whose credit card expired often just needs a friendly reminder to update their payment details.

Building Data-Driven Dunning Processes

One significant benefit of automating your collections process is that it eliminates manual work and gives your accounts receivable team more time to focus on strategic tasks – like gathering the actionable insights that make a real impact on your bottom line.

Chargent’s Automated Collections Dashboard takes you deep into the data on your collections processes, with powerful tools that put your own data to work for you. Ready-to-report analytics let you quickly analyze, then optimize, your collections process to build a data-driven dunning process. You’ll gain a clear view into what works and what doesn’t across your entire AR process – so you can start collecting more revenue.

A/B Testing for Better AR Decisions

One tactic for improving your accounts receivable processes is leveraging A/B testing. Put simply, A/B testing involves comparing two versions of your collections process to figure out which performs better.

Here, we’ve put together a step-by-step guide to using Chargent’s Automated Collections Dashboard to conduct A/B testing on your own collections process:

First, you need to decide specifically what you want to measure and manage.

Are payments returned for insufficient funds an ongoing issue? Try experimenting with the timing of your payment retries. Sending emails to customers that consistently get ignored? Improving the messaging of your email templates, or optimizing the subject line, might yield better results.

Blue vs. Red

Any Salesforce user can configure an Automated Collections process to conduct A/B testing and start tackling payment failures right away. Here’s how:

In this example, we’re going to find out if our customers prefer:

Process A:

- Blue payment request button

- Automated Collections email sent the day of the declined payment

- Automated payment retry after 24 hours

Process B:

- Red payment request button

- Automated Collections email sent the day after the declined payment

- Automated payment retry on the following Friday

Configure and deploy each of these as an Automated Collections process, and assign each one to an even quantity of Chargent Order records. You can utilize Salesforce automation to populate the AC Criteria field on your Chargent Order records.

You’ll want to allow a meaningful number of Chargent Order records to trigger Automated Collections, and for those processes to run to completion.

Show Me the Dunning Data

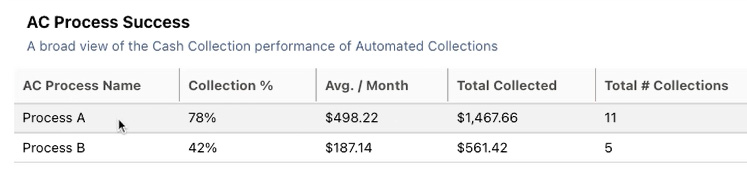

AC Process Success

See a snapshot of the data you collect – like collection percentage, the average amount collected per month, and more.

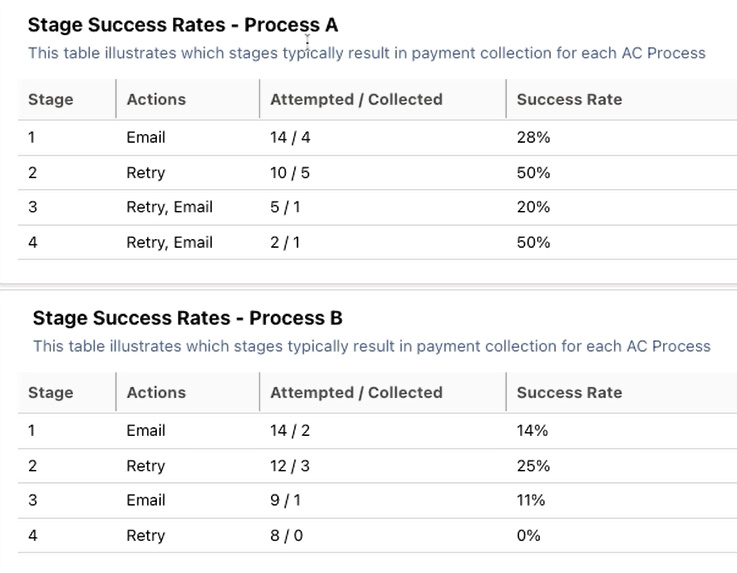

Stage Success Rates

Here, you can drill down into the data, where you’ll see that the same-day customer email, with a blue payment button was the clear winner.

What was it about that stage that was so effective? Does a blue button provide a better customer experience? Or did the messaging of your email notice work particularly well?

It’s easy to continue testing to find out. Your AR team can experiment with every aspect of your collections process to find opportunities for improvement. After all, who is better equipped to identify and implement these changes than your own collections experts?

The ROI of Dunning Management

Making better, data-informed decisions around your AR processes helps you quickly realize ROI on your Automated Collections investment. You’ll see results like:

- Reduced spend on third-party collections

- Better customer retention and lower involuntary churn

- Fewer failed payments

Want to learn more? Find out more about the benefits of automating your collections process. Ready to jump right in to the data? Get started today.