Right now, some of the payments due to you have not been received. So common, yet with far reaching effects you may not think about.

So what’s the problem?

If your company is like most, some of the payments that should have landed in your bank account haven’t yet. You’re spending staff hours and money to fix that, and your bottom line is suffering.

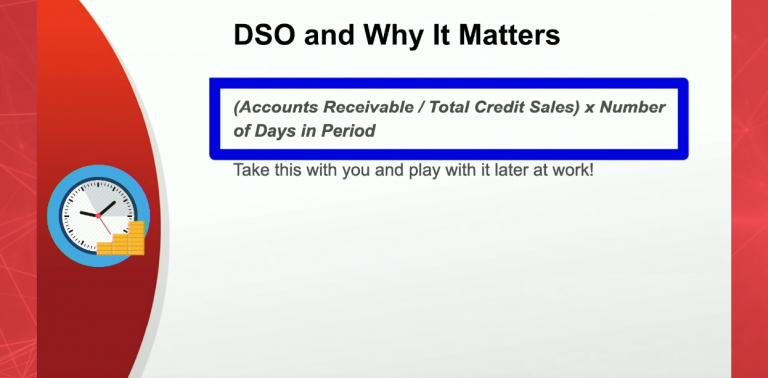

What is DSO?

Days sales outstanding (DSO) is a measure of the average number of days that it takes a company to collect payment after a sale has been made. DSO is often determined on a monthly, quarterly or annual basis, and can be calculated by dividing the amount of accounts receivable during a given period by the total value of credit sales during the same period, and multiplying the result by the number of days in the period measured. In essence it means: How long your company typically takes to collect a payment.

DSO matters because the quicker your company turns sales into cash, the quicker you can put that cash to use. If you aren’t already looking at this metric, I encourage you to start as it can reveal important things about your account receivables.

Here’s the formula for DSO: (Accounts Receivable / Total Credit Sales) x Number of Days in Period

Who is affected by late payments?

The problem of late payments is widespread. When recently surveyed, it was found that:

- 93% of businesses reported late payments from customers. Virtually no business is immune from this problem.

- The average payment term is 27 days, while the average realized payment reception is 61 days.

- Almost 30% of customers use delayed payments as a form of financing.

- Late payments are on the rise.

Late payments touch everything

In that same survey, 40% of businesses had to delay payments to their own suppliers due to this problem. I’m sure that stands out to you like it does to me, because that means:

- Right now, payments are outstanding. Your customers aren’t paying you on time, and you’re not addressing it quickly enough.

- Right now, your cash flow is impacted. Money that you’re supposed to have access to isn’t in your bank account.

- Soon, your supply chain will be impacted, and you won’t have that access to that money to buy supplies, pay staff, or fund expansions and improvements.

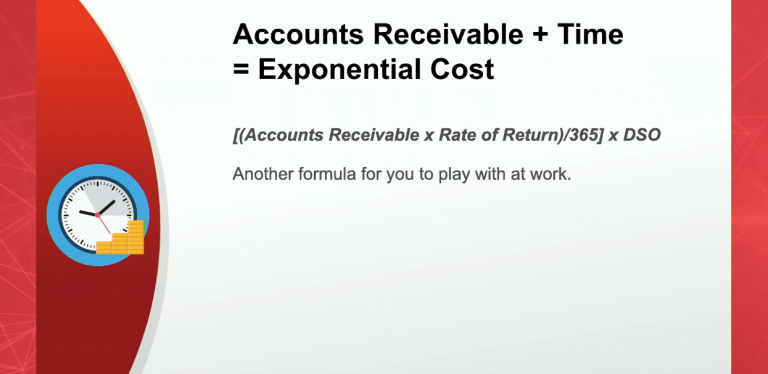

Accounts Receivable + Time = Exponential Cost

So, you can’t just look at the balance sheet for these late payments and interpret the total directly, because the financial impact is always heavier than just that total. Let’s look at that in greater detail:

First we have Administrative Costs: The true cost of managing a receivable comes to around $8.44 per invoice, according to a report published by the Fidesic Corporation. Around 90% of that cost is labor related. Staff hours are expensive. And the higher your DSO, the more that admin cost increases.

Then there’s Opportunity Costs: When you’re waiting for those late payments to be made, you’re also holding off on investments that could be generating more revenue for your company and keeping you competitive.

Finally there’s Bad Debt: The longer you carry Accounts Receivable, the greater the risk of bad debt. This gets unsustainable very quickly if it isn’t managed. For example, a company with a profit margin of 10% that incurs a loss of $10,000 due to bad debt typically must generate about $100,000 in additional revenue just to recover that loss of capital. So there’s a compound effect here, right? You’re in debt because you haven’t collected payments, so you’re not investing as much as you could be, you can’t afford payroll, and you’re taking a loan with an interest rate to cover that.

Here’s the formula you can use to turn Opportunity Costs into a hard number:

[(Accounts Receivable x Rate of Return)/365] x DSO

Scared Yet?

Late payments shouldn’t concern you because ‘concern’ isn’t the right word. They should scare you because of their ripple effect. The vital parts of your company are affected by late payments. If you aren’t scared you’ve either solved this already, or you weren’t aware of the impact.

How can Chargent help?

The most effective ways to speed up your Accounts Receivables are:

- Bill your customers’ credit cards / bank accounts automatically with recurring payments. This is part of Chargent’s core functionality and is far more consistent than sending invoices. (If you haven’t already implemented recurring billing, and it makes sense for your business, get ahold of us here at Chargent and we’ll help you get it up and running.)

- Automate your collections process, which is exactly what our Automated Collections feature accomplishes.

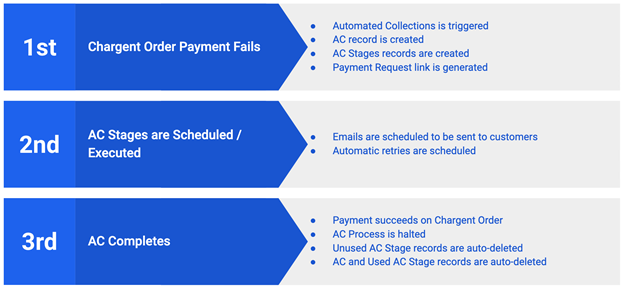

In a nutshell, Automated Collections is the process of automatically communicating with customers and re-attempting card or bank account charges to ensure the collection of accounts receivable. This is how it works:

The retry logic, dates, and emails are chosen by you or your admin during configuration. It takes minutes to activate and configure, and once you’ve done so, Automated Collections is a set-and-forget collections process.

Want to solve your late / missed payments problem? Call or email Chargent today.

Want more? Watch our YouTube video around Automated Collections for Salesforce: